Spoiler alert: Nike Inc. has a foothold in college football.

The Swoosh has been the foremost symbol in athletic apparel for more than a generation, and when it comes to striking expensive deals with the country’s biggest college sports programs, Phil Knight & Co. have gotten busy. In fact, a full 52.3% of the 130 Division I FBS football programs are Nike-affiliated — 68 colleges and universities in all.

That’s a nice majority, but it leaves 62 contracts up for grabs.

So we crunched the numbers to get a lay of the longstanding brand battled land.

Stay Ahead of the Game, Get Our NewslettersSubscribe for the biggest stories in the business of sports and entertainment, daily.

Out of 130 FBS football programs…

Nike has a majority share of FBS apparel deals, covering more than half of the gridiron landscape. Adidas has more school-for-school market share in major college football than Under Armour, Jordan, and New Balance combined, adding programs like Miami and Washington in recent years to massive long-term deals.

Curiously, there’s just one Jordan Brand school in a Group of Five conference: the Houston Cougars. And yes, just one New Balance school, period. More on that in a moment.

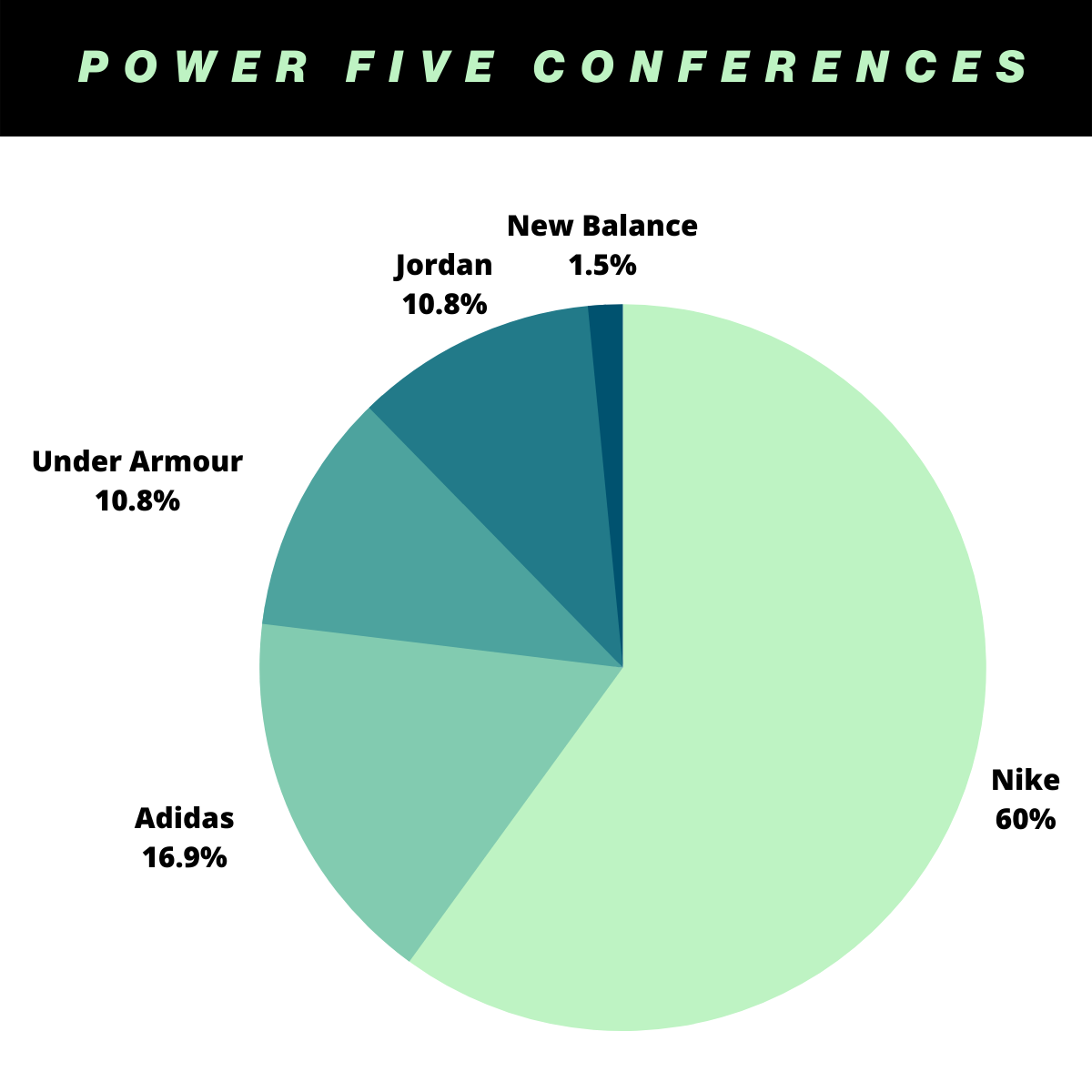

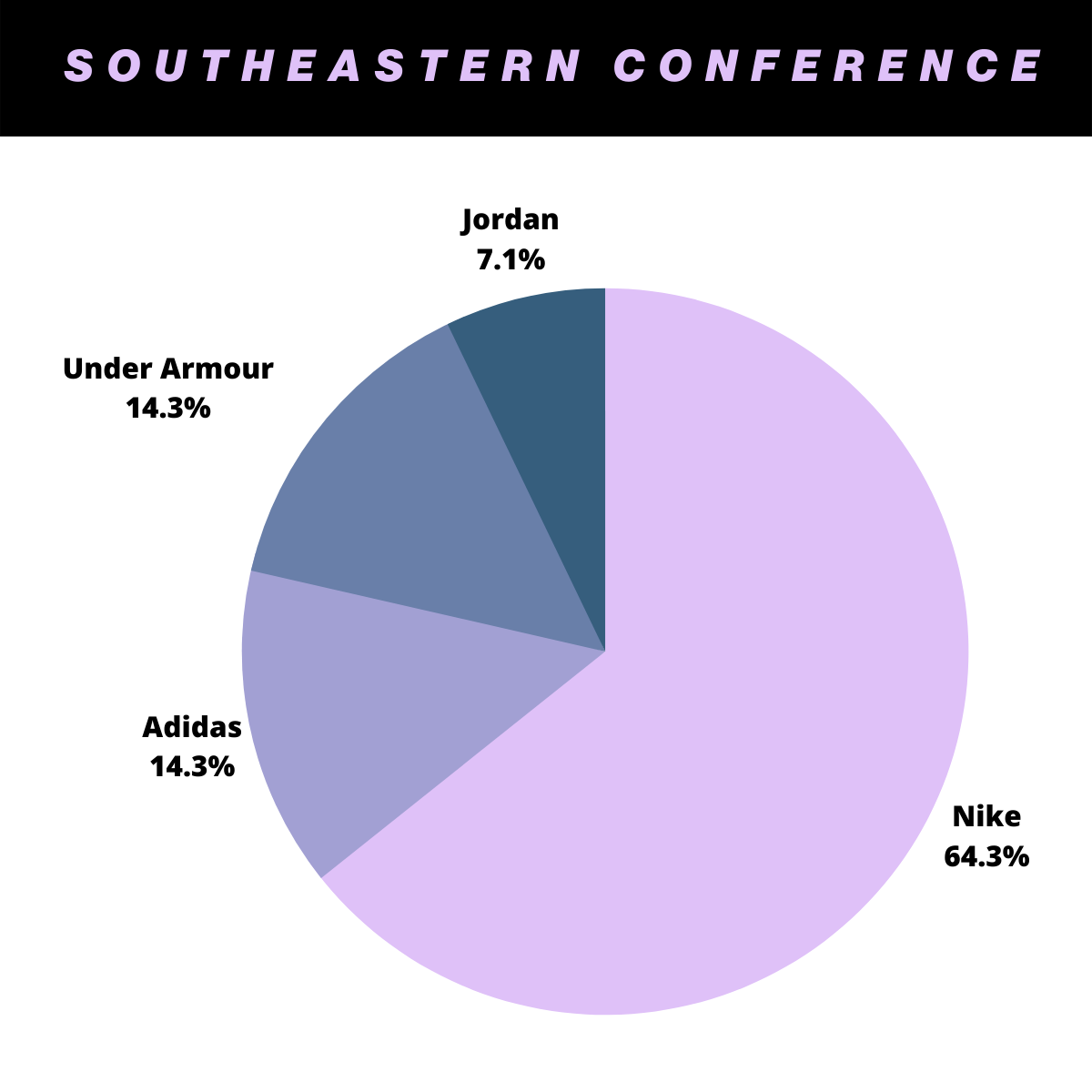

Out of 64 Power Five schools…

At 60%, Nike’s grip on the Power Five conferences (ACC, Big Ten, Big 12, Pac-12, and SEC) is notably stronger than it is across all of FBS football overall. The same can be said for Jordan Brand, which speaks to Nike’s company strategy for the Jumpman — the emphasis has been on transitioning just a select handful of elite programs spread across multiple conferences over from Nike proper, including Florida, Oklahoma, and Michigan.

(Plus MJ’s alma mater down in Chapel Hill, of course.)

As for the one-and-only New Balance school in all of FBS football? That’s right, the Boston College Eagles, whose previous deal with Under Armour was voided back in April due to some brand-friendly, pandemic-driven “out clause” language deep into the contract.

Stepping up to the table with a 10-year offer once Boston College was in need of a new footwear and apparel deal was New Balance, whose headquarters are un-coincidentally also anchored in Boston.

Across the Power Five, Nike’s strongest reign is currently in the 10-team Big 12, where the Swoosh is the official apparel sponsor of seven programs. The conference’s biggest Nike team, thanks to a 15-year contract worth $145 million, happens to be the Texas Longhorns, who are due to bail for the SEC in the coming years.

The similarly departing Oklahoma Sooners are the Big 12’s sole Jordan Brand school.

Nike’s weakest grip, by comparison, can be found in the Big Ten, with seven of 14 schools, making this the only Power Five conference in which the company doesn’t have at least a simple majority. In the wake of Under Armour exiting a few Pac-12 contracts, the Big Ten now has the Power Five’s strongest UA representation, with three schools: Maryland, Northwestern, and Wisconsin.

Nick DePaula covers the footwear industry and endorsement deals surrounding the sporting landscape, with an emphasis on athlete and executive interviews. The Sacramento, California, native has been based in Portland, Oregon, for the last decade, a main hub of sneaker company headquarters. He’ll often argue that How To Lose a Guy in 10 Days is actually an underrated movie, largely because it’s the only time his Sacramento Kings have made the NBA Finals.